Travel Blogger Expenses . Building a successful travel blog. If you have a family or a partner who travels with you, the costs for other people to travel with you are not deductible. This means they pay their taxes to the irs four times a year. Web if you’re a travel blogger, you may be wondering if you can write off your travel expenses on your taxes. Quarterly taxes for people who do not have their taxes automatically withheld from their earnings. Want to become a successful travel blogger? Web as freelancers, travel bloggers are required to file quarterly taxes, four times a year. Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses.

from mtpcomfortinn.com

Building a successful travel blog. Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses. Web as freelancers, travel bloggers are required to file quarterly taxes, four times a year. Want to become a successful travel blogger? Quarterly taxes for people who do not have their taxes automatically withheld from their earnings. If you have a family or a partner who travels with you, the costs for other people to travel with you are not deductible. This means they pay their taxes to the irs four times a year. Web if you’re a travel blogger, you may be wondering if you can write off your travel expenses on your taxes.

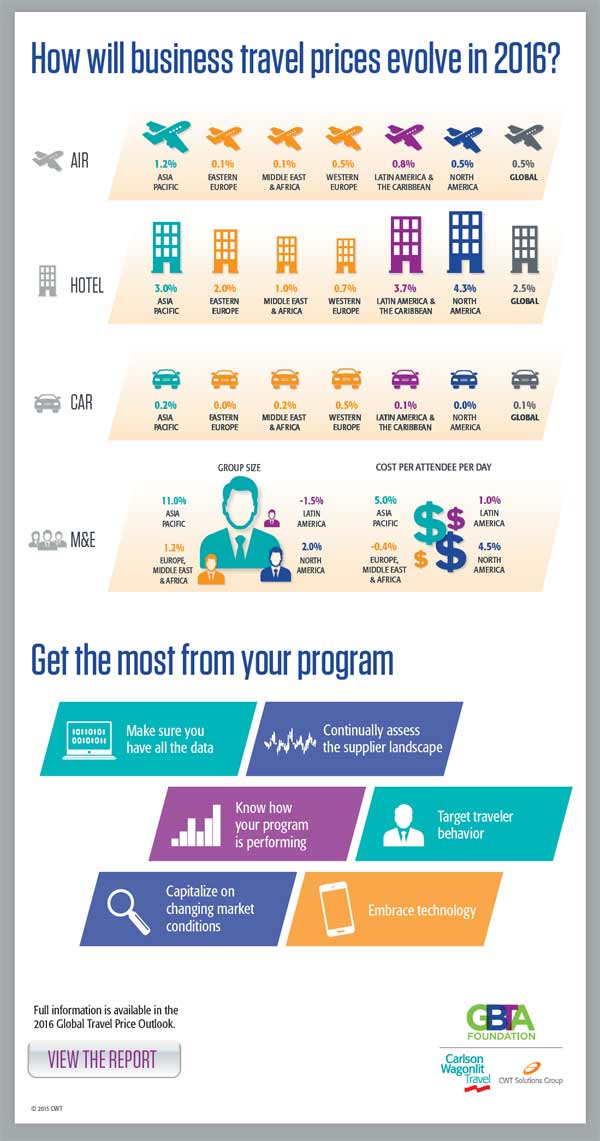

Travel Cost Forecasts What does 2016 Look Like? Comfort Inn

Travel Blogger Expenses Want to become a successful travel blogger? This means they pay their taxes to the irs four times a year. Quarterly taxes for people who do not have their taxes automatically withheld from their earnings. Building a successful travel blog. Want to become a successful travel blogger? Web as freelancers, travel bloggers are required to file quarterly taxes, four times a year. Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses. If you have a family or a partner who travels with you, the costs for other people to travel with you are not deductible. Web if you’re a travel blogger, you may be wondering if you can write off your travel expenses on your taxes.

From www.phenomenalglobe.com

How Much It Costs To Travel The World For 5 Months As A Couple Travel Blogger Expenses Web if you’re a travel blogger, you may be wondering if you can write off your travel expenses on your taxes. Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses. Quarterly taxes for people who do not have their taxes. Travel Blogger Expenses.

From venngage.com

Travel Editions Venngage Travel Blogger Expenses If you have a family or a partner who travels with you, the costs for other people to travel with you are not deductible. Quarterly taxes for people who do not have their taxes automatically withheld from their earnings. This means they pay their taxes to the irs four times a year. Web if you’re a travel blogger, you may. Travel Blogger Expenses.

From www.budgetair.com

Top 8 Travel Blogs you Need to Follow Blog Travel Blogger Expenses This means they pay their taxes to the irs four times a year. Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses. Web as freelancers, travel bloggers are required to file quarterly taxes, four times a year. Web if you’re. Travel Blogger Expenses.

From www.bloggingwp.com

Top 5 Tips for Starting a New Travel Blog Travel Blogger Expenses Building a successful travel blog. Quarterly taxes for people who do not have their taxes automatically withheld from their earnings. Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses. Web if you’re a travel blogger, you may be wondering if. Travel Blogger Expenses.

From bethebudget.com

15 Ways To Make Money As A Travel Blogger Be The Budget Travel Blogger Expenses Web if you’re a travel blogger, you may be wondering if you can write off your travel expenses on your taxes. Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses. If you have a family or a partner who travels. Travel Blogger Expenses.

From www.youtube.com

Travel Blogger Salary Blogger Earnings (ALL THE DETAILS!) YouTube Travel Blogger Expenses If you have a family or a partner who travels with you, the costs for other people to travel with you are not deductible. Web if you’re a travel blogger, you may be wondering if you can write off your travel expenses on your taxes. Web if you are the type of blogger who is traveling to places for new. Travel Blogger Expenses.

From shailajav.com

Best Blog Budget Tips How to plan expenses for your blog Travel Blogger Expenses This means they pay their taxes to the irs four times a year. Building a successful travel blog. Web as freelancers, travel bloggers are required to file quarterly taxes, four times a year. Web if you’re a travel blogger, you may be wondering if you can write off your travel expenses on your taxes. Web if you are the type. Travel Blogger Expenses.

From adniasolutions.com

Travel Budget Planning Template Adnia Solutions Travel Blogger Expenses Web as freelancers, travel bloggers are required to file quarterly taxes, four times a year. Building a successful travel blog. Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses. If you have a family or a partner who travels with. Travel Blogger Expenses.

From eduardklein.com

How to a successful travel blogger while working fulltime. Travel Blogger Expenses If you have a family or a partner who travels with you, the costs for other people to travel with you are not deductible. Web as freelancers, travel bloggers are required to file quarterly taxes, four times a year. This means they pay their taxes to the irs four times a year. Quarterly taxes for people who do not have. Travel Blogger Expenses.

From www.pinterest.com

23 Jobs with Travel the ultimate list of travel jobs (that will take Travel Blogger Expenses Building a successful travel blog. Quarterly taxes for people who do not have their taxes automatically withheld from their earnings. Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses. Web if you’re a travel blogger, you may be wondering if. Travel Blogger Expenses.

From www.myglobalviewpoint.com

Travel Blog Salary How I Make Over 20,000 Per Month Travel Blogger Expenses Want to become a successful travel blogger? Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses. Building a successful travel blog. Web if you’re a travel blogger, you may be wondering if you can write off your travel expenses on. Travel Blogger Expenses.

From travelvos.blogspot.com

Travel Expenses Two Year Rule TRAVELVOS Travel Blogger Expenses If you have a family or a partner who travels with you, the costs for other people to travel with you are not deductible. Quarterly taxes for people who do not have their taxes automatically withheld from their earnings. This means they pay their taxes to the irs four times a year. Building a successful travel blog. Web if you’re. Travel Blogger Expenses.

From www.pinterest.de

Ultimate Travel Checklist. 28 Overlooked (But Essential) Things To Do Travel Blogger Expenses If you have a family or a partner who travels with you, the costs for other people to travel with you are not deductible. Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses. Web as freelancers, travel bloggers are required. Travel Blogger Expenses.

From www.pinterest.com

How much does it cost to travel the world for 2 amazing years? Our Travel Blogger Expenses Web if you’re a travel blogger, you may be wondering if you can write off your travel expenses on your taxes. Building a successful travel blog. This means they pay their taxes to the irs four times a year. If you have a family or a partner who travels with you, the costs for other people to travel with you. Travel Blogger Expenses.

From vickyflipfloptravels.com

What’s the Average Travel Blogger Salary? (+ Reports) Travel Blogger Expenses This means they pay their taxes to the irs four times a year. Building a successful travel blog. Quarterly taxes for people who do not have their taxes automatically withheld from their earnings. If you have a family or a partner who travels with you, the costs for other people to travel with you are not deductible. Want to become. Travel Blogger Expenses.

From www.pandle.com

Can Small Business Owners Claim Meals And Travel Expenses? Pandle Travel Blogger Expenses If you have a family or a partner who travels with you, the costs for other people to travel with you are not deductible. Building a successful travel blog. Quarterly taxes for people who do not have their taxes automatically withheld from their earnings. This means they pay their taxes to the irs four times a year. Web if you. Travel Blogger Expenses.

From bloggingguide.com

Best Travel Blog Examples Blogging Guide Travel Blogger Expenses If you have a family or a partner who travels with you, the costs for other people to travel with you are not deductible. This means they pay their taxes to the irs four times a year. Web as freelancers, travel bloggers are required to file quarterly taxes, four times a year. Web if you are the type of blogger. Travel Blogger Expenses.

From mtpcomfortinn.com

Travel Cost Forecasts What does 2016 Look Like? Comfort Inn Travel Blogger Expenses Building a successful travel blog. Quarterly taxes for people who do not have their taxes automatically withheld from their earnings. Web if you are the type of blogger who is traveling to places for new posts for your blog, then the travel costs for you only, are deductible expenses. This means they pay their taxes to the irs four times. Travel Blogger Expenses.